The UK’s gas grid could be ready to deliver blended hydrogen this year. Over the last few years, the government have been looking at ways to introduce blended hydrogen into the gas network. HyDeploy is a government-backed project which has been testing hydrogen’s viability over the last few years.

HyDeploy looks at understanding how hydrogen can be used to play a role in combating climate change. HyDeploy is one of a number of initiatives (including Hy4Heat) focusing on hydrogen and how, by blending up to 20% hydrogen into the natural gas network, we can reduce carbon dioxide emissions without altering how we heat our homes. Various tests in local areas have proved very successful.

Britain’s Hydrogen Blending Delivery Plan:

The ENA (Energy Networks Association) has now published Britain’s Hydrogen Blending Delivery Plan. This plan sets out how all five of Britain’s gas grid companies will reach the Government target for a network of pipes ready to deliver 20% blended hydrogen to both homes and businesses around the UK.

Mixing natural gas with up to 20% hydrogen could lead to large carbon savings. If 20% hydrogen is blended into the gas grid together with existing natural gas, this could save up to 6 million tonnes of carbon dioxide equivalent every year, which is about the same as taking 2.5 million cars off the road or 41 million tonnes saved by the year 2032!

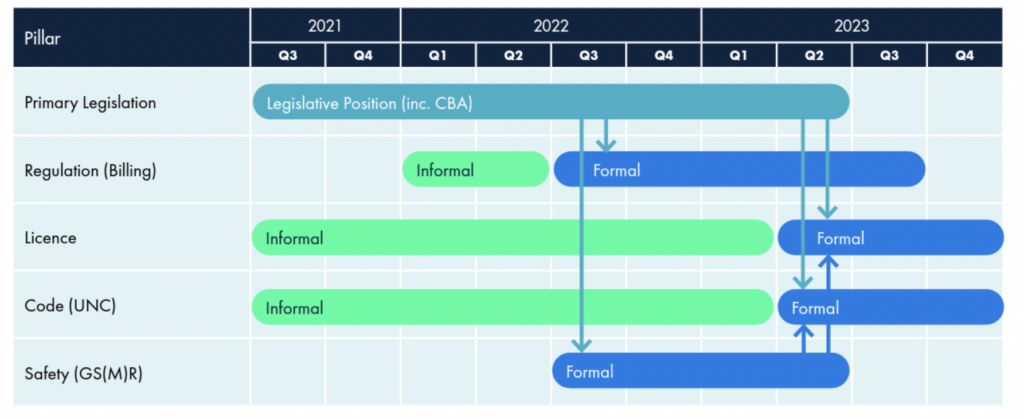

There are a number of key parts of the gas market which need to be considered with this blended hydrogen rollout to make sure there is a well-organised and visible plan. Five pillars have been established to provide assistance; these are:

Primary Legislation – The main laws passed by the UK Parliament are subject to Parliamentary review. This pillar is related to any laws that impact the gas industry and would therefore need a full Parliamentary change process.

Regulation – The “regulation” pillar looks at secondary parliamentary legislation, like Statutory Instruments. These sorts of legislation can be changed without Parliament passing a new Act. This pillar is focused on the secondary legislation change linked to the billing regime (e.g. the Calculation of Thermal Energy Regulations).

Licence Change – Ofgem (Office of Gas and Electricity Markets) regulates the UK gas industry by granting licences to parties to undertake specific activities. This market pillar looks at changes needed to modify these industry-wide licences.

Code Change – The Uniform Network Code [UNC] outlines the rights and responsibilities for users of gas transportation systems, making sure all users have the same access to various transportation services. Compliance with the UNC is a licence condition (e.g. UNC & IGT UNC).

Safety Change – To ensure safe operation, gas delivery to networks need to be within certain pre-determined limits as outlined in legislation. The current gas quality limits are set out in the [GS(M)R]. So this market pillar focuses on safety-related change, mainly in relation to how GS(M)R would change to expand the allowable hydrogen range up to a 20% limit.

More on the technical details relating to these pillars can be found at – https://www.energynetworks.org/industry-hub/resource-library/britains-hydrogen-blending-delivery-plan.pdf

These pillars are subject to a timeline, shown below, which was been created by the Energy Networks Association and has been published in their aforementioned report.

These pillars started back in 2021, and if all goes to plan in Q4 of 2023, we could very well see one of the largest changes to the gas network ever witnessed as we make progress towards Net Zero.

Roll-Out Models:

In order to support the market and regulatory changes needed to allow hydrogen blending, it was considered important to understand at a high level what regime the market rules would be creating. A strategic approach and free market approach were created for further consideration:

The Strategic Approach – would designate connection locations based on the most suitable parts of the network, considering a number of potential factors, including maximising hydrogen blending volumes and determining where on the network would allow efficient control and operation of blends.

Free Market Approach – The Free Market Approach copies the current arrangements for connections to the gas networks and would allow the market to decide where to inject hydrogen into the network, with the hydrogen capacity being made available on a “first come, first served” basis.

In Conclusion – Rolling The Plan Out:

1. A 2023 timeline (as above) to roll this out across all five of Britain’s gas network companies to make sure homes can benefit from this 20% hydrogen blend.

2. The BEIS (Department of Business, Energy & Industrial Strategy) should choose from two options for the energy infrastructure changes that need to be created to allow hydrogen blending to take place from 2023 – a Strategic Approach and a Free Market Approach.

3. The legal changes which need to be made by Government and regulatory bodies across the five key market pillars (outlined above) to make sure gas companies can start blending later this year.

We will report on progress as these exciting plans further develop in the year.